Vandey PF Procedure

Provident Fund:

PF is a mandatory saving for an employee by the government of India for employees which consists of contributions on the basic salary. Employees Provident Fund (EPF) is a scheme in which retirement benefits are accumulated. Employees’ Provident Fund (EPF) is a retirement benefits scheme maintained by the Employees’ Provident Fund Organization (EPFO). The employee and the employer contribute to the EPF scheme on monthly basis in equal proportions of 12% (24% total) of the basic salary.

Percentage applicable is

-

For salaries above 15000 INR per month, employees can contribute 24% of Basic Salary (This is optional up to a minimum of 1800 per side)

-

For salaries less than or equal to 15000, the Minimum is 3600 INR (1800 per side)

This adds up along with the interest for the accruing period and can be withdrawn by employees as and when they leave the organization.

-

Employees whose (Basic) salary is INR. 15,600 (above 15,000 INR) per month at the time of joining, based on his previous UAN status will be categorized into PF or exempted from it.

-

Employees with more than 25,000 INR will compulsorily be into PF and the whole the amount will be adjusted from his CTC (Not the same for applicable cases of promotion where the employee has joined with salary of above 15,000INR and below 20,000 INR)

-

Employees drawing less than Rs 15,000 per month must mandatorily become members of the EPF.

-

An employee has been a part of PF earlier (And has a UAN Number), He/She does not have a choice but to continue.

Benefits:

-

PF is saving for an employee that could be used in times of distress.

-

Tax Savings for employees with a higher pay scale.

-

10 years of contributory membership ensures a life-long pension under the Employees' Pension Scheme 1995.

-

Members can avail the facility of withdrawals for the purpose of Covid outbreak, purchase/construction of house, repayment of house, illness, higher education, marriage, etc.

-

Individual who is unemployed for a period of more than 2 months can apply for withdrawal

-

Pension Benefits - PF contributed for long-term converts into pension plans which enables to support the member financially after retirement.

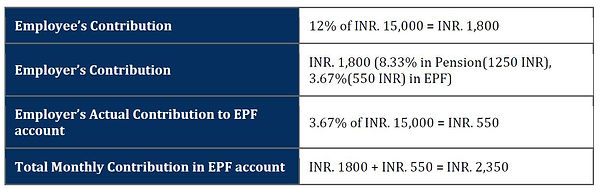

Breakup:

UAN activation:

In order to activate your UAN, follow the steps given below:

Step 1: You need to visit the member website of EPF i.e. https://unifiedportalmem.epfindia.gov.in/memberinterface/

Step 2: On the right corner below, you will find the option of ‘Activate UAN’ and click on it.

Step 3: As the member home dashboard opens up, enter your UAN/member ID along with your Aadhaar number, name, date of birth, mobile number according to EPFO records.

Step 4: Enter the ‘captcha’ code and get an authorization PIN on your registered mobile with EPFO.

Step 5: Use the One Time Password (OTP) to validate and activate the UAN online.

Step 6: Another message will be sent to confirm the activation of the UAN.

Step 7: Once UAN is activated, you can log in using it to check the status of the Provident Fund.

EPF e-Nomination

EPFO has made it mandatory for EPF members to file nomination details. It is to make sure that in case of an unfortunate incident of the member’s demise, the family gets the adequate savings that the member has generated during the work tenure. UAN members, those who have not filed their nominations will not be able to access their passbook online as well.

An EPFO member needs the following details to file e-nomination – Aadhaar number, name, date of birth, gender, relation, address, bank account details and photograph. Submitted details then have to be verified using the e-Sign facility.

*This is mandatory for all employees covered under PF.

How to check EPF Balance?

A member can check the EPF balance accumulated in the account online by following these simple steps:

Step 1: Visit EPF’s website at www.epfindia.gov.in

Step 2: Go to ‘For Employees’ under the “Services” section

Step 3: Click on the ‘Member Passbook’ option

Step 4: Now enter your ‘UAN’, password, and captcha code and login into your EPF account

Step 5: Select the ‘Member ID’ to view your passbook

Step 6: Your UAN passbook will be displayed with complete details in the document.

How to link your EPF account with Aadhaar online?

You can easily link your Aadhaar to your EPF account online. Follow the steps given below:

Step 1: Visit the EPFO member portal and log in using your credentials

Step 2: Go to the ‘Manage’ option from the menu bar

Step 3: From the drop-down list, select the ‘KYC’ option

Step 4: Select ‘Aadhaar’ from the list of documents

Step 5: Enter your Aadhaar Number and Name as per Aadhaar

Step 6: Save and proceed

Step 7: Your Aadhaar data will be verified with UIDAI’s data

On successful approval, your Aadhaar will be linked with your EPF account and you can see the Verified status written against your Aadhaar details.

How to Transfer EPF Online?

Step 1: Log in to the EPFO members’ portal using your UAN and password

Step 2: Go to the ‘Online Services’ tab on the main menu of the home page and select ‘Transfer Request’ to generate an online transfer request.

Step 3: A new dashboard displaying all your personal details will be shown. Verify all of that like DOB, EPF and date of joining, etc. so as to claim the process.

Step 4: Once you verify, go to Step 1, select the option of previous or present employer and then provide the details of the previous employer through which you want to claim.

Step 5: Submit the details, an OTP will be sent to your registered mobile number. You need to authenticate your identity by entering the OTP, then only the request will be submitted and an online filled-in form will be generated. You need to sign the form and send it to your present or previous employer.

Step 6: The employer will also get an online notification about the EPF transfer request. EPFO Office will process the claim only after the employer digitally forwards the claim to the EPFO after verifying your employment details.

Post submission of the request, you can check the status of your EPF transfer claim under the ‘Track Claim Status’ menu, which is under the ‘Online Services’ menu.

EPF Withdrawal

EPF can be partially or completely withdrawn. Complete withdrawal is allowed when an individual retires or if he/she remains unemployed for more than 2 months. Whereas, partial EPF withdrawal is allowed under certain circumstances. You can make a withdrawal claim by filling out the EPF withdrawal form online. However, you can use the online withdrawal claim facility only if your Aadhaar is linked with your UAN.

Follow the steps given below to fill out the EPF withdrawal form and initiate a claim online:-

Step 1 – Sign in to the UAN Member Portal with your UAN and Password.

Step 2 - From the top menu bar, click on the ‘Online Services’ tab and select ‘Claim (Form-31, 19 & 10C)’ from the drop-down menu.

Step 3 – Member Details will be displayed on the screen. Enter the last 4 digits of your bank account and click on ‘Verify‘

Step 4 – Click on ‘Yes’ to sign the certificate of the undertaking and proceed further

Step 5 – Now click on the ‘Proceed for Online Claim’ option

Step 6 – Select ‘PF Advance (Form 31)’ to withdraw your funds online

Step 7 – A fresh section of the form will open, wherein you have to select the ‘Purpose for which advance is required, the amount required, and the employee’s address. It is worth noting that all options for which the employee is not eligible for withdrawal will be mentioned in red.

Step 8 – Tick on the certification and submit your application

Step 9 – You may have to submit scanned documents depending on the purpose for which you have filled the form.

Step 10 – Your employer has to approve your withdrawal request after which the money will be withdrawn from your EPF account and deposited in the bank account mentioned at the time of filling the withdrawal form.

SMS notification will be sent to your mobile number registered with EPFO. Once the claim is processed, the amount will be transferred to your bank account. Although no formal time limit has been provided by the EPFO, the money usually gets credited within 15-20 days.

Payslip representations:

1. The offer letter represents CTC in case of employees earning more than 25,000 INR per month, for employees less than 25,000 INR offer letter reflects the gross salary.

2. The payslips are designed to reflect the gross salary which includes only the employee contribution.

3. The difference between the gross and CTC is the employer’s contribution of PF (1800INR).

4. E.g. If an offer letter represents that the employee's salary is 45,000 INR per month, this will include the PF contribution by employer, so your payslip will reflect 1,800 INR less than your offer letter.

5. For employees whose salary is 15,100 (anything less than 25,000) in the offer letter, the offer letter represents gross salary and not CTC, in such a case, the payslip will reflect the amount as mentioned in the offer letter.

Link for explanation:

https://www.youtube.com/watch?v=lBagn--KERk